Posted on November 22. 2023 at 18:40Miss à jour till November twenty second. 2023 at 19:05

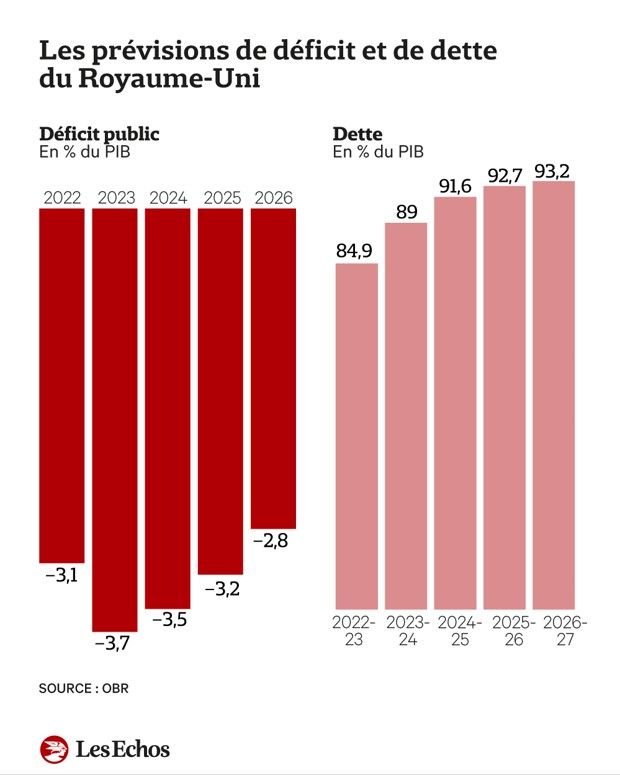

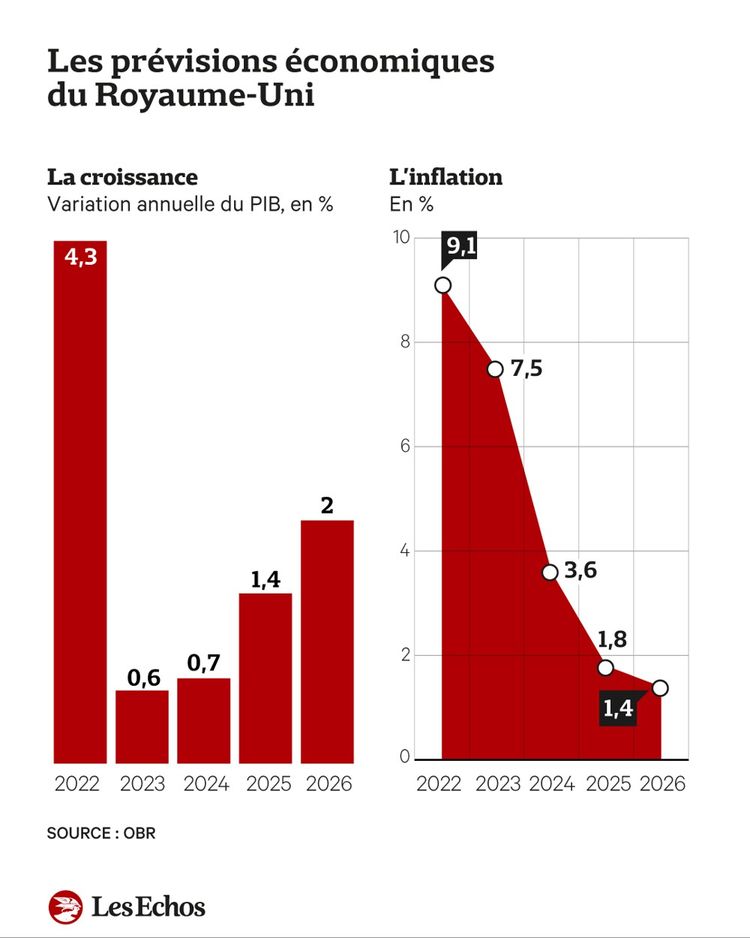

This increase came about extra strongly in 2024, which could be very helpful in 2024. Inflation each time, which is much less fast than anticipated. That is the portrait painted by the Workplace for Finances Accountability (OBR), the British authorities’s life in public funds.

Finance Minister Jeremy Hunt, who introduced his resignation, stated he would offer £27 billion in loans to revive the UK financial system nationwide.

“After a pandemic and a significant disaster, we are going to take tough measures to place the financial system again on monitor, and announce the present finances, with out the slogan being ‘lifting funding obstacles’ and ‘compensating’ work.” «Notre pour l’économie britannique fonctionne plan, mais le travail n’est pas terminé», in il ajouté.

27 billion extra prescriptions

The announcement of those budgets is made higher after the start of the 12 months than earlier than the finances plan. The Royal College has reaped £27 billion in extra monetary outlay within the context of robust inflation and a revaluation of public salaries.

Its affect is turning into huge, as a result of residual revenue funds revenues are disappearing after the pandemic. Shortly earlier than the following election, underneath stress from the Conservative Celebration majority in Parliament, Jeremy Hunt determined to distribute this virtually full “card”.

“Typically, within the case of remarkable recipes, the prospect of saving on the encircling setting is as much as 60%. This time the choice has been made to increase all,” stated Richard Hughes, head of the OBR.

An enormous blow to funding

Royal College places companies on the coronary heart of this relationship. The principle measure, amounting to $9 billion, consists of a fiscal low cost on non-public funding. “It’s crucial company tax fee in fashionable British historical past,” says Jeremy Hunt.

This important saving is along with the $4.5 billion in subsidies beforehand introduced to assist the trade convert electrical automobiles or plane to zero emissions. Social advantages reform ought to induce a return to work and in addition eradicate primary work pensions.

Home du salaire minimal

Within the curiosity of corporations, the federal government introduced a discount in social expenditures by two factors, at a value of 10 billion kilos to public funds, along with a minimal wage enhance of 11.44 kilos per hour. The state pension is aligned to the wage home, in order that the home is at 8.5%.

“This bundle of relaxed measures on provide coverage ought to assist assist progress in the long run. “We need to scale back funds in a accountable method,” stated Charlotte Truthful, State Treasurer, sponsored by Eco. These reforms will stimulate 0.3% water manufacturing for five years, after OBR.

Taxes in the home

On the identical time, advance doses in UK PIB will proceed to extend. This paradox is defined by conserving the mortgage quantity over income. From 2028, 4 million UK constitution flights will fall into the mortgage and three million will go by means of the extra tranche, if this continues, after the OBR. It’s a whole quantity of 45 billion kilos for shareholders.

One other space of this finances: the ceiling imposed on the Public Expenditure Home continues, so long as inflation places robust stress on the budgets of the ministries. Paul Johnson, director of the Institute for Fiscal Research, believes that it’s “essential” to “take the chance that these initiatives can’t be actual,” and that these loans should not “workable.”

Rachel Reeves, Labour’s public finance MP, estimates that “the irrigation introduced as we speak on no account offsets” the life disaster created by the British Lists.