Revealed on December 13. 2023 at 16:46Yesterday till December 13. 2023 at 17:10

In France, consumption is pilier de la croissance. For many individuals, that is the start of the return of the inflation interval 2021. The Insee within the “Portrait Social” collection was revealed final month. The income base and primary courses must be saved to a minimal and forestall their expenditure even on primary capabilities similar to vitamin or vitality.

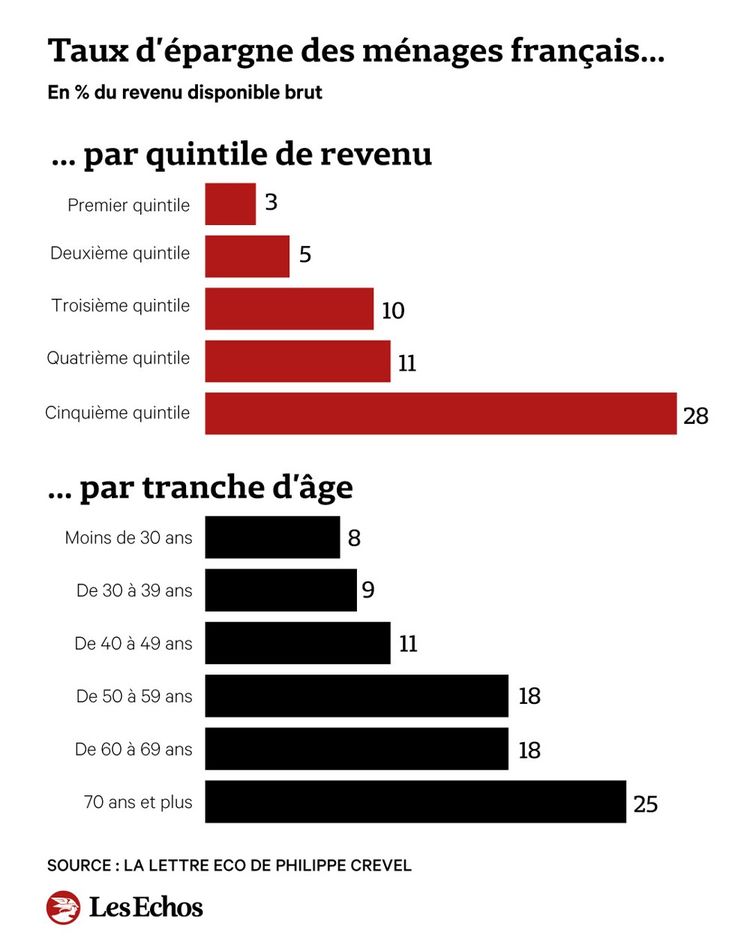

Due to the dynamism of salaries and the rise of their income revenue from their property (income…) With the rise within the suppression of the housing tax, the extra support is a variety of the most effective variety and has equal advantages on the idea that the remainder: the quantity paid from the extra 20% of wealth additionally rises to twenty-eight% of Income obtainable for the common-or-garden 3%.

“Life cycle principle” is loopy

The French want to make reservations, naturally discovering liberal professions, prime cadres, and freelancers who’re consistently transferring ahead.

However the actual shock is that the Child Boomers, who had change into so nice at worshiping the fantastic thirties, have subsequently transformed to donation. Further married life (since 1953) has a variety of room for cash and has the identical benefit that others save lower than 1 / 4 of their whole disposable revenue, equal to an extra 7.5 factors than the quantity of financial savings from French meals may be outdated (17, 5%).

The mystique of the “child boomer era,” which existed between 1955 and 1963 and was roughly 60 to 69 years outdated — continues to be a good distance from reaching an 18% financial savings fee at underneath thirty. What’s 8%.

“Which means Franco Modigliani’s ‘life cycle’ principle, which asserts that the return to departure, is anarchic,” famous Patrick Artus, financial advisor at Natixis. “One other situation of grades,” he notes, is that older ages select extra dangerous placements for youthful folks. “Variance of Income Uncertainties for Every Doable 12 months,” Economics Estimates. Philippe Crevel, who directs Le Cercle de l’épargne avanc une autre explication: « Plus on possède un patrimoine necessary, plus on prend de risques. »

Transfer du patrimoine

Touch upon whether or not outdated cigarettes expire formis ? « Boomers are on the verge of getting kids: the proportion of excessive pensioners who’re over the restrict, are not greater than kids on charges, and are additionally changing into actual house owners of the primary residence », décrypte l’professional.

Motives are various. Much like the custom of thrift in France, a will constitutes a protecting haven for the financing of credit score occasions in addition to the need to cross on a legacy to future generations. “This can be a section with the truth that France is recovering a legacy firm,” spiritualist Patrick Artus, who mentioned that “heritage wealth represents 60% of the full French heritage,” in comparison with 35% originally of the 1970 years.

Offshore farmers and freelancers are individuals who save more cash with the quantity of financial savings reaching 35% and 31% respectively.