Posted on December 18. 2023 at 19:09Miss today on December 18. 2023 at 19:16

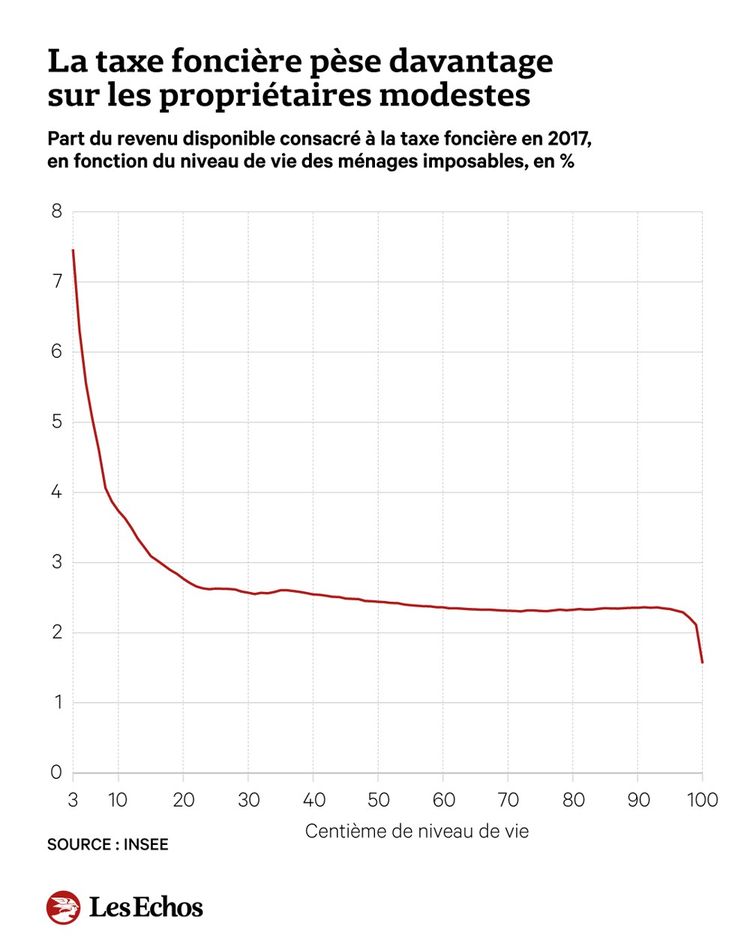

The telephone quantity is unjust? After noticing a be aware from l’Insee dévoilée ce lundi, you’ll get pleasure from all the most effective on small property homeowners with better wealth. That is completely true if he’s interested by fortune papers or heritage papers.

Researchers have been recognized with a brand new base of information, detailing the actual property heritage of French travels in 2017. When the collections of taxes paid are associated to the accessible revenues, the machine exhibits that the trouble of the modest homeowners is nice in addition to excessive. The latter are restricted to greater than 4% of their assets from luxurious taxes, whereas the typical is 2.5%. This extra 1% of information can’t be greater than 1.5% of their income in a single month.

Native values are outdated

This regressive character is much more obvious if the inheritance worth of mounted property is taken under consideration. In a steady method, the dimensions of the belief is diminished as the worth of the stabilizer actions will increase. For Prime 0.1% listings, the bottom tax is 0.17% of the actual property worth, so there’s a wave within the itemizing pool (0.34% in 2017).

The primary rationalization for this obvious paradox is that the tax imposed is calculated from the home worth of the finances – that means the worth might be theoretical. Or “The rise out there worth of the area is excessive, and the ratio between the native worth and the market worth is weak for the time being,” ship a be aware from l’Insee. This connection is partly damaged by these older properties, which have been repaired or greater than 5 years outdated.

“The parameters that had been decided in 1970 to offer a greater character to the brand new constructions of this period, which had been right this moment’s terraced decorations, and of excessive worth for outdated properties within the metropolis middle, right this moment will likely be triple-deck,” defined Pierre Moscovici. The primary president of the Court docket of Accounts. This distinction in origins is all the pieces. Communities with no vital exercise on their territory are inclined to have extra established native guidelines to extend taxes and have better dynamism.

View crucial locations in center-ville

The phenomenon is outstanding in massive gatherings, particularly within the Parisian area. Giant metropolis middle townhouses, with massive tons, profit from native worth commensurate with potential and little upside in comparison with massive suburban clusters, which deal with extra modest homeowners.

« This quantities to a luxurious tax that may spend 3 times extra within the accessible income in Seine-Saint-Denis in Paris. That is what occurred », notes Pierre Moscovici, who mentioned on this textual content – désormais documentée – a plus motif to remettre à plat la facilité foncière.