Printed on December 7. 2023 at 6:15

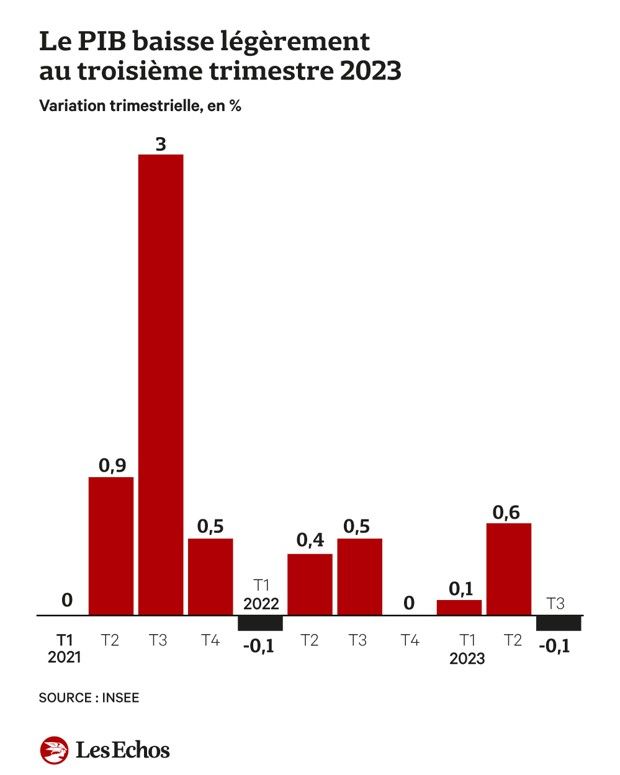

Now that there is been extra time, anxiousness is competing with forecasters. The French financial system is ready to keep away from recession by “approach”, by studying the conclusion over the past three months of the PIB, following the normal definition of economists? Revisions of statistics are economically essential. As a substitute of progressing by 0.1% within the first three months, exercise is lastly responded to by 0.1%, marking the ultimate week of the examine. A minimal correction will surely take the French financial system into destructive territory.

“This isn’t a brand new good factor. Prenons garde néanmoins à ne pas la surinterpreter. The share of 0,1%, is a measure of the attribute, relative Mathieu Blanc, economizes in l’OFCE who factors out that “the irony is that the numbers of labor creativity within the hexagram within the final three months, eux, été révisés fortement à la hausse.”

Completion of the bloodbath

The checklist of hexagonal economics is definitely no shock. “That is in keeping with the questions of the scenario,” asserted Charles-Henri Colombier of Rexecode, who sees “a excessive diploma of likelihood” that France will enter a recession.

Actually, aside from the second third of the month by which exercise led to a 0.6% shock, the French financial system is finishing up a month later in a type of lethargy, with progress near zero. «And we convey une croissance nulle au quatrième three triestre», to consult with the Rexecode knowledgeable.

The curiosity cost shock spreads turbulently throughout the financial spectrum. Throughout all sectors, indicators of pumping exercise are multiplying, and company failures are taking house payouts. Through the month and October, manufacturing was 0.4% under the 2022 degree throughout the identical interval.

Dynamism in providers that smooths out volatility for a very long time additionally slows it down. « Les Mises in chantier sont à 250,000 en rythme annualisé, un niveau que la France n’avait pas connu depuis le début des années à 250,000 en rythme annualisé, un niveau que la France n’avait pas connu depuis le début des années à 250,000 en rythme annuisé, un niveau que la France n’avait pas connu depuis le début des années à 2019, famous the looks of Bruno Cavallier, financial chef at Oddo BHF.

In at present’s inflationary surroundings, residual consumption and exterior demand are dynamic, which will be achieved by acceleration within the Eurozone, particularly the recession occurring in Germany. In and of themselves, corporations are very hesitant. “Relative indicators within the labor market generate nice knowledge, which ends up in indicators of failure. Furthermore, the inside work which is a sophisticated indicator of the event of the exercise is oriented in the direction of the decrease degree, factors out the Oddo BHF knowledgeable.

Croissant “Animic”

The next strings are introduced incessantly. “The query is to know whether or not the exercise remains to be failing or whether or not it’s falling inside an extreme stagnation course of. At this second, nobody permits you to take into consideration altering the financial configuration,” says Mathieu Airplane.

“The dangers to the French financial system haven’t worsened in comparison with October,” stated Evelyn Hermann, an economist at Financial institution of America World Analysis, who’s monitoring whether or not six-year progress “stays weak till the top of the primary quarter of 2024.” In the meantime, France is a superb place for different eurozone nations to return “since it’s a part of a extra favorable scenario.” “The French authorities could be very fast to burn the value of power that may keep away from dangerous results on the financial system,” he defined.

The remainder “2024 will start with very modest good points,” the spirit of Charles-Henri Colombier. Thus, as uncertainties turn out to be largely new. The de-inflation course of requires some recycling by decreasing its dimension. However “enchancment in livability could also be equated with much less funding and fewer employment,” whereas defending the financial system.

Ceylon Bruno Cavaliere, remarrying from the perilous conclusion, overcomes two obstacles. «Initially, the reminiscence of excessive costs, it’s troublesome to vary the administration psychology of what it is dependent upon. That is what could result in time publicity danger. However, it shouldn’t be as prudent whether or not analysis on the labor market succeeds beneath inflation as whether or not they may stay prudent,” he defined.

In every case the explanation, the PIB ratio of 1,4% was launched by Percy with a purpose to present an optimistic collection of consultants who can use the moment pill in additional than +0,8%.