Posted on January 20. 2024 at 14:05

In Davos, Emmanuel Macron insisted that Europe’s financial sovereignty have to be considerably strengthened. The Covid epidemic, the credit score cuts that continued, after which the warfare in Ukraine weren’t proof of the weak spot of manufacturing chains and the continued dependence on French financial cloth in direction of outsiders. Along with the truth that corporations are massive, along with the idea of financial sovereignty that doesn’t enable it to take care of something, it loses the prize of public conscience.

That is what reveals the third version of the truth sovereignty scale by OpinionWay of société de conseil en achats, By.O. Assortment and launch by “Les Echos”. The survey was carried out between October 9 and November 3, 2023 after 506 managers. 82% of French corporations oppose “sovereignty”, however the breaking line is designed between small and medium-sized cells that share this imaginative and prescient and the most important teams.

The latter has a distinct imaginative and prescient: after seeing two (45%) it isn’t “sovereign”. A fee larger than 5 factors till 2022 and 9 factors by 2021. That is preferable in an {industry} sector that’s regaining dependence on international nations.

Frine la croissant

“Sovereignty is an phantasm for giant enterprise,” mentioned Mark Debbetts, president of By.O. group. For all of the managers of those main teams, this dependence on confirmed suppliers outdoors the borders is a visit to the start of 2022, they usually haven’t bought 37% to enter the nation to develop.

Always, the problem of sovereignty has develop into an actual, mountain of lever within the public debate on the query of Russian power or Chinese language mineral sources.

Tensions on logistics chains have been a topic of nice concern over the previous years, and entry to uncooked supplies (and their prices), intermediaries essential for manufacturing and R&D sources is a serious concern for giant corporations. Even when the problem will not be as acute in smaller-scale societies, the context of warfare in Ukraine and the Close to East urges vigilance. The implications of the power disaster are rising considerably: Seven are likely to estimate that the corona has an affect on their prices or their capabilities to make sure this 12 months’s manufacturing.

Resettlement

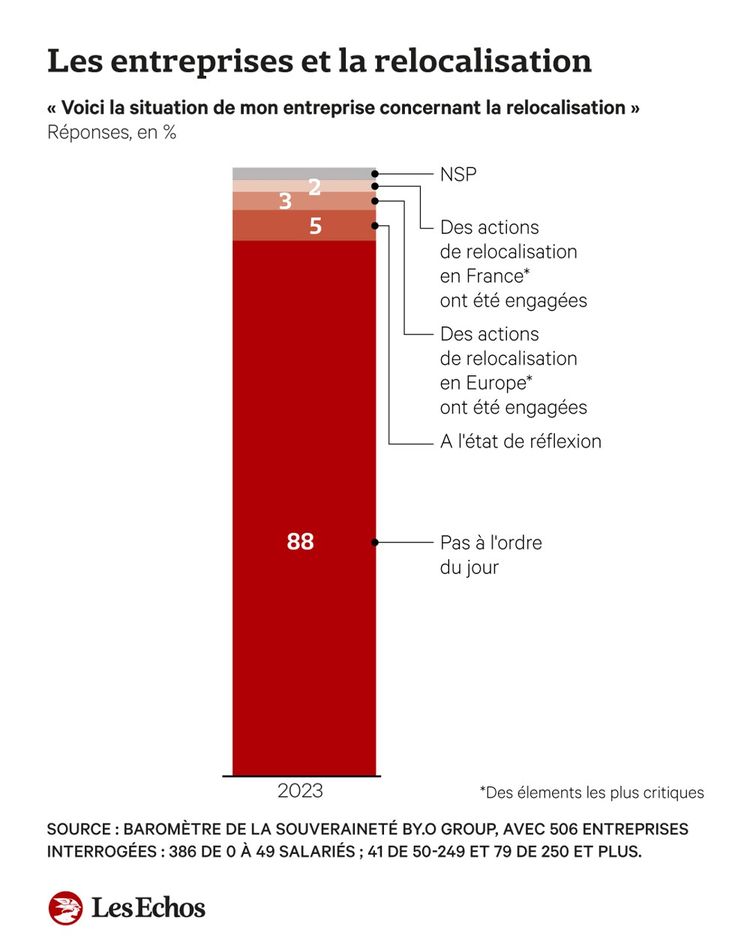

On the identical time, the repositioning technique that Emmanuel Macron desires will not be truly an answer to handle company dependence. Solely 5% of the 506 managers questioned had been concerned in an motion under 2% in France on industry-related initiatives which can be gated by PME and small middleman companies (ETI). For 90% of the beneficiaries of the probe, they’re completely resettled “pas à l’ordre du jour”, as of 2022.

Giant teams look like a quite simple thought for actions. Fairly a number of (28%) are additionally not keen to interact in resettlement procedures in Europe, in comparison with 3% in 2022, and 43% are heading right into a undertaking (in opposition to 15%).

The hexagon will now not be resettled, after the scanning course of has been carried out. “The competitors prize is the primary impediment. Giant corporations which have relocated wish to get well key enterprise prices », evaluation by Mark Dibbets.