Printed on December 28. 2023 at 6:56

The time is not more than the monetary revolution. The final years can be recognized for a lot of irregularities: rising retention at supply in 2020, reviewing debt tranches on revenues in 2021, abolishing the housing tax between 2018 and 2023… Compared, the Millésime 2024 apparaît bien sage. Further changes are price making spiritually. Horizon tour:

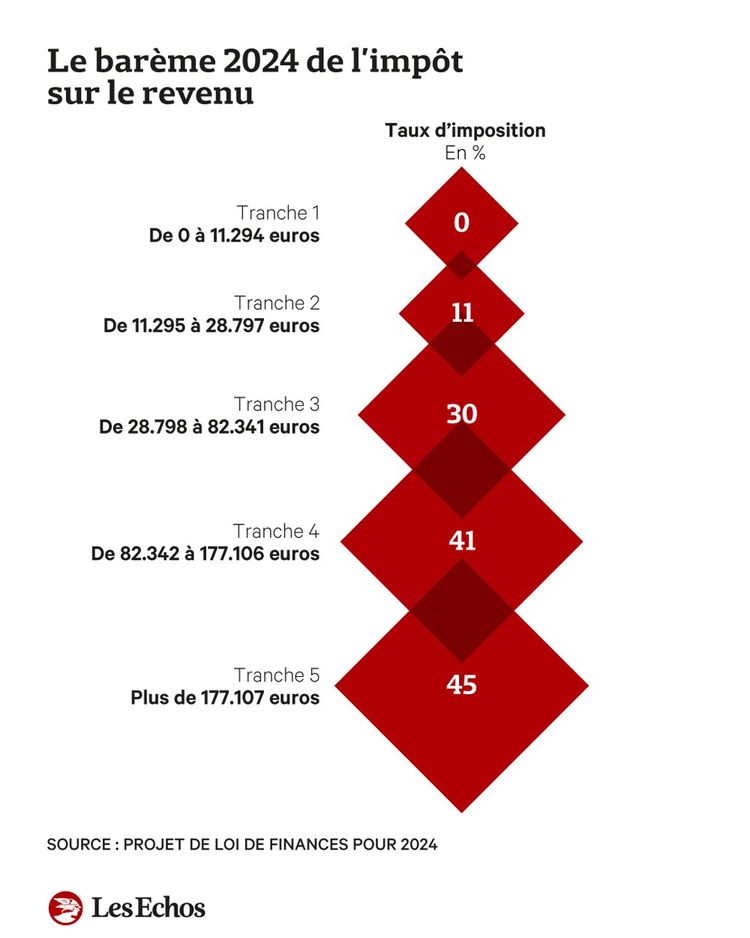

· Mortgage funds are at an inflation-linked income degree

As a normal matter, the Authorities has determined to regulate the IR quantity utilized within the 2023 Income in an effort to account for the event of the award. The next variations will improve by 4,8%.

Cylon Percy, this indexation represents a strategy to increase 6.1 billion euros for public funds. The true revenue of contributions relies on the complete growth of their revenues. Following a examine by the Institute of Public Coverage (IPP), the reformable French will begin investing in 2024 – on the newest – when salaries will advance beneath the speed of inflation.

This is not going to be revenge for extra wealth. Since then, the Distinctive Contribution to Excessive Earnings (CEHR) bar has not advanced. This tax can be added at 3% to the IR for increased incomes of €250,000 (for a single individual), and 4% as much as €500,000. With robust inflation in these current years, along with a rise within the contributions granted to them. They may attain 50,000 in 2022, for 1.5 billion euros, for 40,000 euros in whole.

· The tax workplace at residence

It is one other sudden outcome for the value of the home. Inflation is utilized to cadastral inhabitants values, serving a calculation base for added taxes: taxation of small and non-residential property, in addition to taxation of the clearance of younger animals. Subsequent time, the return is lower than 3.9%.

Les communes Gardent toutefois la major sur le taux relevant. Every year, they could determine to not go any additional in 2024 (which is mimicked by a easy 3.9%) by going up or going again down. After this dialogue, it’s probably that the brand new tax in 2024 can be again on the rise with house owners in 2023. A big quantity of native values that had been crucial at 7,1% has added energy to the tax improve in lots of main cities: +52% in Paris, +25% in Grenoble, +9% in Lyon…

Thus, vacation residence house owners can get a second little shock: to counter actual property tensions, the federal government has reached out to an extra 2.500 municipalities for the potential of rising the housing tax on second houses (THRS). The identify between them, Bonifacio à Chamonix through Riec-sur-Bélon (Finistère), is just not particular.

· Taxes on remaining electrical energy

The modification turned outdated throughout debate within the Senate. This was retained by the Authorities within the authorized textual content because of 49.3. Percy reserves the potential of reinstallation in 2024, by decree, on the degree of TICFE (inner tax on closing consumption of electrical energy). The price of electrical energy has been considerably lowered in 2022, by as much as €32 per €1 per megawatt hour, to mitigate the affect of the power disaster on French electrical energy payments.

With the general electrical energy worth rising in these current months, the federal government is imposing charges to pay a part of these payments. If this quantity is ample, the federal government might additionally profit from beginning to return the extent of taxes to the superior disaster degree. €15 per MWh was talked about by the Finances Minister through the discussions.

The federal government confirms that upon reaching the value of electrical energy, together with all taxes, the value of electrical energy can be lowered to 10% subsequent February.

· Airbnb’s monetary price range is more likely to be sound

Followers of first-class vacation houses will proceed to profit from a 71% discount in revenues for areas beneath €188,700. The federal government leaves some “bug” within the Finance Act by means of a Senate modification that overrides this characteristic. However this means that this measure can be decided for 2023 revenues that can be introduced in print.

That is affirmation that the chief department leaves behind all of the skeptics some monetary individuals consider that this could obtain the aim of justice. As for the wing, the federal government has indicated to everybody that it needs to cut back the specialised monetary price range for “Airbnb”, later within the 2025 price range. The extent of discount remains to be to be decided.

· Mortgage failure in movable actual property wealth

Since 2018, the mortgage on wealth (ISF) has been changed by the mortgage on actual property wealth (IFI). You may as well use it within the raquette. « Whereas the system was launched in 2018, the IFC charges weren’t compulsorily imposed as quickly as non-public residential properties or within the firm had been made out there, in lower than a second, Job Pressure de la société sont par Principe déductibles de l’assit imposable, Whether or not the info is appropriate or not à l’immobilier », defined Philippe Gossett, affiliate lawyer CMS Francis Lefebvre. The federal government believes that this creates in some individuals a spillover impact which can be corrected within the 2024 Finance Act.

Particularly, the corporate’s money owed taken out of IFI belongings are restricted to solely these properties. “A reserve clause of as little as attainable was launched to restrict the probabilities that might be imposed on the worth of components of society and to keep away from a attainable shock,” particularly Philippe Gosset.

· The current bilateral settlement

The mechanism for transferring a enterprise by means of donation or succession – the well-known Dutreil constitution that exempts heirs from 75% of fee rights – is it a canopy for a excessive honor? By 2024, the contributions in query can be halted in an effort to meet the minimal. The monetary regulation results in the exclusion of latest or flat website actions, which can’t profit extra from this benefit system.

What raises the query of the good thing about donors as heirs presumptive, is that the opposite prior modification to the settlement exclusion mitigates all actions that aren’t important to the industrial exploitation of the enterprise: small motion. This proposal was rejected by the federal government even earlier than the price range check started, but it surely will not be a part of the mission.