Posted on November 22. 2023 at 14:57Miss à jour till November 23. 2023 at 12:02

In the newest rental bought, Claire is a black shock. On the letterbox, a fee courier arrives, demanding €918 in housing tax on secondary housing, to be paid earlier than 15 December. “What number of college students had been lower than half, and received just a little little bit of a collective hit, this 22-year-old scholar, Raconte. If I haven’t got a compagnée with my messages, they inform me what they pay with out refléchir. »

On the telephone, the fee agent confirms that it’s going to trigger an error and explains that it’s certainly “new” with related statements. Superior Rationalization from Percy: The software program estimates that Claire will reside in a main residence when her dad and mom are at a drawback of their monetary foyer. Son appartement étudiant was accommodated in secondary housing. Or if the federal government abolishes the housing tax for the principle residence, will probably be lively for secondary residences.

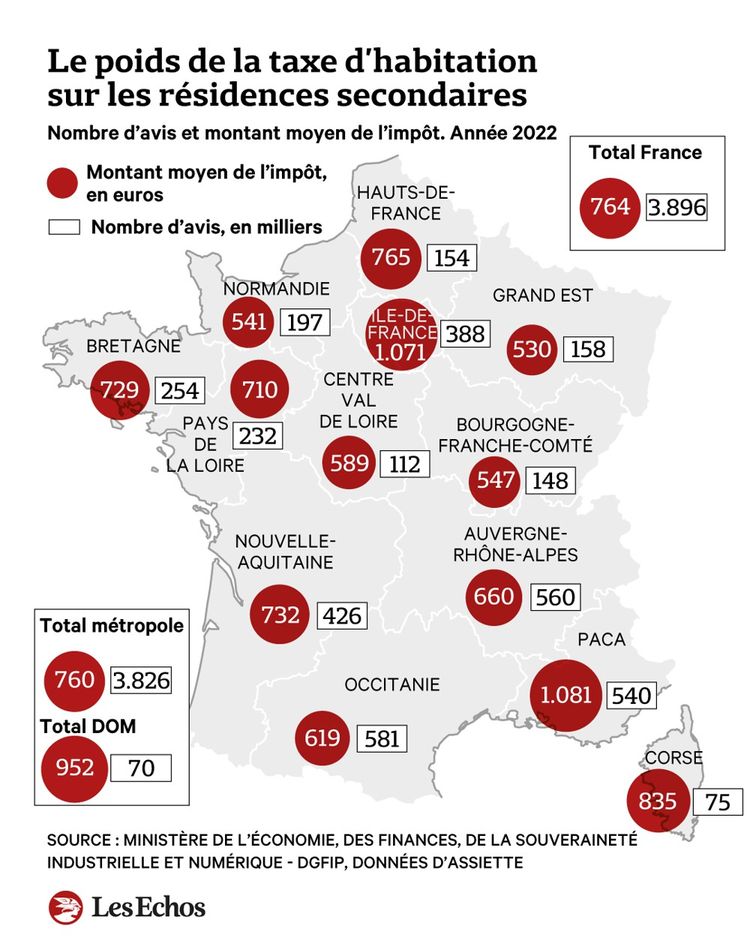

4 million envoys

Many municipalities supply the potential of further taxation of those vacation houses, that are invoiced in extra of lots of of tens of millions of euros for the respective contributions. Furthermore, the messages despatched in these final days are partly on the floor of the portray. Percy does not make any errors, however I can guarantee you that there might be no requests or requests on the topic in 2022.

The Ministry has delivered 70% of the Housing Tax Notices for Secondary Residence (THRS) beforehand marketed in a press release issued by the Solidaires Funds Publiques union. After that, “the THRS quantity was elevated by 3% this yr” to keep away from 4 million.

The remainder of the distant positions are many. There are college students who make a part of their efforts in social networking. It’s also very straightforward for younger youngsters to be a number of years previous since they’ve acquired a housing tax discover of their title. “These are marginal positions which might be recognized by our companies and for which taxes are robotically decrease, with out contributions making them occur,” Percy mentioned.

“Extra house owners can recuperate secondary taxes on a ‘tax’ on their balcony for instance,” an addition to all this from Solidaires Funds Publiques. Effectively, it is a letter addressed to a person who has been recognized since September. Or get recruitment cupboard sponsor BCG Conseils who’re asking for €800 for his or her native professionals. « Get a fast telephone name whenever you say this well-known housing tax does not exist any greater than it does, and that is full! » Rationalization-t-il.

GMBI fiasco.

For unions, the vast majority of these funds are responsible for failing to declare incapability to maneuver. Beginning in 2023, monetary administration might be obtainable to request from micro enterprise house owners if their residence is occupied and equal. The initiative, which goals to establish short-term and vacant housing in addition to housing tax wants, takes place on-line on the tax web site, through the tag “Gérer mes biens immobiliers” (GMBI).

Extra fast use of gasoline. On this case, the enterprise description doesn’t correspond to actuality, so the nice a part of the house owners merely doesn’t embody what’s required. Bilan, malgré three successive experiences on the date of the utmost promoting, earlier than an proprietor is 5 years away from promoting each… With out them speaking about that could be a trompe l’oeil of their promoting.

Or if a residence is just not declared occupied, the second residence tax will apply robotically. The identical is the case when the occupant has marketed his or her main residence via a viewpoint for the administration – as is the case for college students sliding into the guardian monetary room.

«In fact, the method is reversible, and the housing tax might be canceled within the account, however this requires a refund and a disputed process after the availability of public monetary companies, we remorse the Solidaires Funds Publiques union. Official timing, on an annual foundation for shareholders and public finance brokers and brokers, considerably someday. ».

Percy Relative: “We’re in industrial operations, 39 million in monetary houses, 24 million in landlords, 4 million in housing taxes on secondary residences yearly, and the like errors on the sting.”